All Categories

Featured

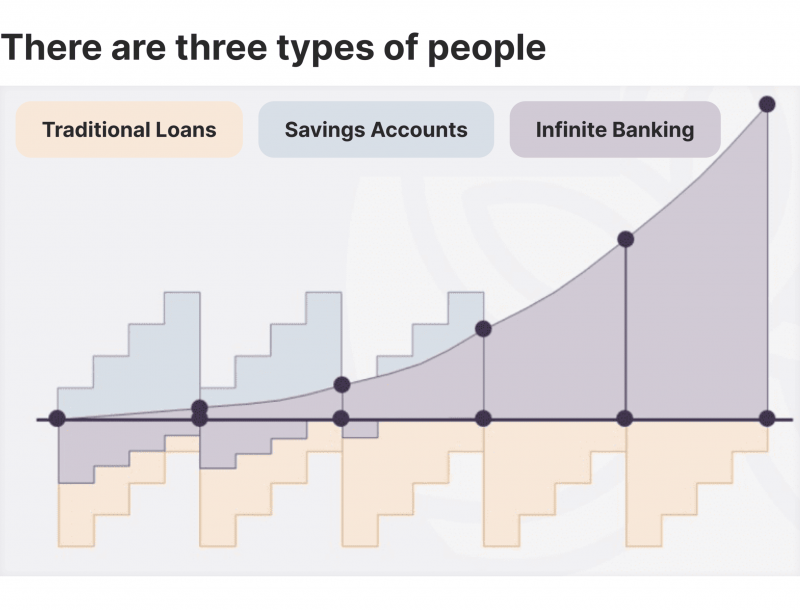

Entire life insurance policy policies are non-correlated assets - Infinite Banking. This is why they function so well as the financial foundation of Infinite Financial. No matter what occurs on the market (supply, realty, or otherwise), your insurance coverage maintains its worth. Too numerous individuals are missing out on this necessary volatility barrier that assists secure and expand wide range, rather splitting their cash into two containers: savings account and financial investments.

Market-based financial investments expand riches much quicker yet are exposed to market variations, making them inherently risky. What if there were a 3rd container that supplied safety however additionally moderate, guaranteed returns? Entire life insurance policy is that third pail. No matter of just how varied you think your profile might be, at the end of the day, a market-based investment is a market-based financial investment.

Latest Posts

Infinite Bank

Can Financial Independence Through Infinite Banking protect me in an economic downturn?

How do interest rates affect Policy Loans?